Real Estate and Housing Forecast 2018 to 2020

Mar 1, 2018. Buying or Selling a house or condo in 2018 or 2019? How do you feel right now about the 2018 housing market? Is the recent pessimism justified? Save

Save

Millennials still hopeful to buy a home in 2018

This completely updated EPIC United States Housing Report has market updates and predictions for 2018 to 2020, and other data to 2026.

IN this post, you’ll discover the hottest city markets, zip codes, get economic, employment, finance, and housing projections to understand the key fundamentals driving rental investment, home construction and the real estate markets in 2018/2019 to 2026.

What’s the story for winter 2018? It has to be Texas and Michigan, however the overall picture is of a very good spring for the housing market nationwide and going forward to 2026. Population growth in San Francisco, Denver, Houston, Seattle, and Phoenix. The western migration is strong, as will those housing markets will be.

Save

SaveThe Complete Picture for 2018

Ready to choose your realtor and buy a house or condo this year? The outlook is really rosy! And how about investing in a rental income property for sustained passive income? This current lull might make the next 3 months the best time to buy. The outlook is as positive as could be for buyers. Lock in your mortgage rate.Overall, predictions and outlook for the US housing market are positive. That’s because the US economy is on its strongest roll ever, bolstered by lower taxes, improved trading agreements, growing American confidence, happiness, comfort, freedom and the American dream has been kindled again.

Take a look at more detailed reports of major US city markets: Latest Posts: San Francisco Housing Market | | Boston Real Estate Market 2018 | Florida Housing Forecast 2018 | Miami Housing Market | Los Angeles Real Estate Forecast | New York Real Estate Predictions | Houston Market Forecast | Houston Real Estate Forecast | Seattle Housing Forecast

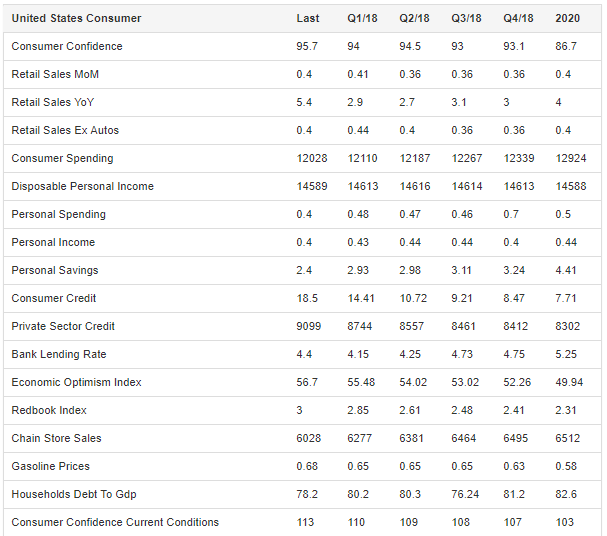

This graphic courtesy of Trading Economics shows the top sign that the real estate market will be healthy for some time, and that buying a home is a wise investment (Trading economics is a very informative site, have a visit afterward).

Save

SaveForeign investment has been strong because the world knows, the US is the place to be. American’s have always had a great attitude toward risk and business growth. Now the economy and business markets are allowing that spirit an opportunity to pay off.

NAR/Realtor Outlook on the Housing Market

| Housing Indicator | Realtor.com® 2018 Forecast |

| Home price appreciation | 3.2% increase |

| Mortgage rate | Average 4.6% mortage rates in 2018 to 5.0% (30 year fixed) by year end |

| Existing home sales | 2.5% growth, low inventory problem easing |

| Housing starts | 3% growth in home building 7% growth in houses |

| New home sales | Growth of 7% |

| Home ownership rate | Stabilizing at 63.9% nationally |

The resistance to housing development is slowing. Conservatives are giving up amidst intense pressure by those facing outrageous housing shortages and skyrocketing rental prices.

Housing Shortages Won’t Ease

Although January’s sales were disappointing, it’s due to the severe shortage of housing. Demand is there and you’ll be competing against a hoard of buyers in 2018. Corelogic expects 2018’s home prices will grow 4.3% by next December. NAR and Realtors® expect only a 3% growth in prices this year. Nevada, Texas, Washington, and Florida are the states with the best outlook, and perhaps the best places to buy homes or rental properties.The Bay Area, Portland, and Seattle areas saw the highest growth in prices last year while LA’s tumbled. Listings fell dramatically in cental California, Oregon, Washington, and New York.

Consumer mood was not so good in July of last year, mostly due to government problems. Yet the market came flying back. These challenges overcome mean more Americans will have more confidence in their personal situation.

The US Economy 2018/2019

These stats from Trading Economics show positive fundamentals that will drive growth in the housing market, and in turn will bolster the economy, since new household consumer spending and housing investment is a key driver of the economy.

Home prices should begin rising again this late spring in Florida, New York , Boston, San Diego, Houston, Miami, Seattle, Bay Area and the rest of overheated California.

Buyers and sellers will enjoy the market trends, stats, threats, and the key factors including housing construction starts described below. Enjoy the big picture!

We Buy Houses Louisville/ Eagle Thirteen Properties

No comments:

Post a Comment