Let’s

face it. Bandit signs, those small plastic “WE BUY HOUSES” signs posted

on telephone polls and at intersections, are the Kanye West of the real

estate industry. The people that love them think they’re absolutely

brilliant, and the people that hate them… well, they just wish they’d go

away. As divisive as they are, we took a deep dive on the state of

bandit signs in 2017 to see if they’re still a good way to generate

leads.

For more (legal) ways to generate leads, check out

our top 43 real estate lead generation ideas.

Okay, throw on some music that gets you amped about making more money (

our pick) and let’s get started.

Where To Buy Bandit Signs (And How Much They Cost)

Source: Phillip’s Natural World

You can purchase bandit signs at any online or brick and mortar sign

shop. Coroplast (corrugated plastic), is both weather resistant, and

fade resistant, so it should be your first choice. You can buy them for

as low as $1.99 each. Then you’re going to want to stock up on staples, a

heavy duty staple gun, zip ties, or maybe even a

dedicated sign stapler.

The Psychology Behind Bandit Signs: Why They Work

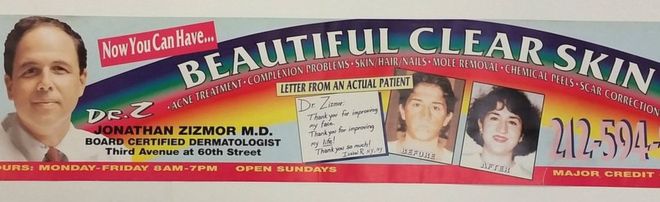

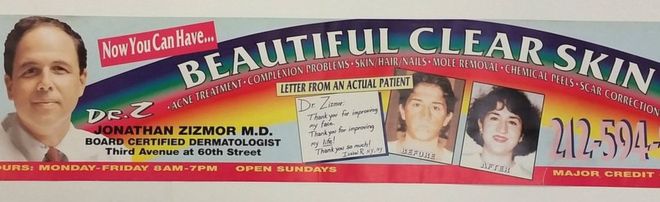

Source: New York Transit Museum via BBC.com

For more than thirty years Dr Jonathan Zizmor has been running the

same decidedly un-slick ad in the New York City subway system. It’s

dominated by a garish rainbow, a confusing and cluttered hodge podge of

different fonts, and a layout that’s well…there’s no other way to say

it, ugly.

As silly as it looks, the design flaws were probably no accident. Here’s Dr Zizmor himself explaining his ads to

Business Insider:

“I was getting all my fancy-schmancy people, but I wanted

to see the rest of the world,” he said. “Most people don’t even know a

dermatologist.”

How many people know a professional real estate investor?

9 out of 10 People Agree…

If you were to ask ten New Yorkers what they think of Dr Zizmor’s ad,

nine of them would probably just roll their eyes and laugh. After all,

the ads are pretty silly looking.

Of course Jonathan Zizmor doesn’t care about nine out of ten New

Yorkers. He cares about the 10th New Yorker. The one who works a lower

wage job and has severe acne, or maybe an embarrassing scar. For them

Zizmor’s ad is a serious one—they don’t see a silly ad. they see a

doctor who is

approachable. Someone who won’t look down their

nose at them or make them feel inferior for having an embarrassing skin

condition. A doctor who looks like a

regular person, terrible taste in graphic design and all.

That tenth person might have been putting off treatment for years, or

even decades. They’re probably worried that they can’t afford treatment

at all. They’re also probably more than a little embarrassed to be

looking for acne treatment or scar removal in the first place. Despite

all this, they’re finally ready to throw in the towel and call a

dermatologist. On the subway the next morning, they’re confronted with

this ad:

Source: Laser Dermatology NYC

Again, they’re a little bit embarrassed, they’re worried about not

being able to afford treatment, but they’re still committed to calling a

dermatologist TODAY. Who do you think they’re more likely to call?

Since you’re reading an article about bandit signs you probably

already guessed the answer. They’re going to call Dr Zizmor. Wouldn’t

you?

Why Desperate Homeowners Respond to Bandit Signs

If you’ve been working as an

investor,

rehabber, or

wholesaler

for a few years, that tenth New Yorker who called Dr Zizmor probably

reminded you of someone: A homeowner who needs to sell their house

quickly. Think about it. They’re probably embarrassed to be so close to

foreclosure,

they definitely don’t have a lot of money in the bank, they need to

sell yesterday, and probably think they’re going to get taken for a ride

by the broker in the gleaming

S Class and Saks Fifth Avenue pantsuit.

Here’s what most desperate homeowners who need to sell are looking for in buyer:

- Someone they can relate to

- Someone who won’t make them feel ashamed

- Someone who might be closer to their economic level

- Someone who will tell it to them straight

- Someone who they might be able to out negotiate

- Someone who speaks plainly

For many homeowners who find themselves in stressful financial

situations, calling a number on a bandit sign might make a lot more

sense (at least emotionally) than heading over to the local boutique

real estate office.

Now that you have a better idea of why bandit signs work so well,

let’s dive in and look at the 7 problems you’ll encounter when using

them. Even better, we’ll show you how to avoid those problems and start

generating leads with bandit signs.

The 6 HUGE Problems with Bandit Signs in 2017 (and how to avoid them)

Before you start getting excited about how many new

fix and flip projects

you’re going to get from a weekend of posting bandit signs, you need to

understand the risks. Here’s a quick rundown of the risks and potential

downsides of bandits signs.

1. They’re Called Bandit Signs For a Reason…

Bandit

sign is not just a catchy name. Bandit signs are called bandit signs

for a very good reason; in many municipalities bandit signs are actually

illegal.

Yes, really. Despite (or maybe because of) the recent explosion of interest in

fix and flip and rental investing, many local communities have been

cracking down on bandit signs. In Philadelphia for example, a weekend spent putting up bandit signs

can cost you as much as $75 per sign.

Putting up 20 signs, which is not an unusually high number for many

investors, might end up costing you $1500 in the city of Philadelphia.

In Orange County Florida, the fine is

$150 per sign. That’s $3000 for twenty signs…

How to Avoid Getting Getting Fined in 2017

Let’s not beat around the bush here. The only way to truly avoid

getting fined for putting up bandit signs is to not post them at all.

After all,

cold calling FSBOs, signing up for

Zillow Premier Agent Direct, or mastering

Facebook ads

can get you great listings too. That said, since you’ve gotten this far

into the article, you might want to know how creative investors avoid

paying fines. Here are a few of their ideas.

Get permission from property owners

Although local ordinances might affect them as well, owners of

private property are probably going to be a lot more forgiving than the

local government. If you’re nice, they may let you put up your signs for

free. If it’s a really prime location (busy intersection, downtown area

near public transportation etc) then it might even make sense to work

out a deal. Would you pay $50 for 5 good leads? I know I would.

Talk to your lawyer

Let’s face it. Legal statutes, even at the local level, can be

byzantine and opaque unless you’re a lawyer. Instead of crossing your

fingers and guessing, buy your lawyer an expensive lunch and ask them.

Put your signs up on Friday night and take them down Sunday night.

Some agents recommend putting your signs up on Friday and taking them

down Sunday night. Since they work for the government, the odds of a

code compliance officer working on the weekend are pretty slim. You also

might avoid the ire of the local community. If they see you’re at least

making an effort to not visually pollute their neighborhood, they may

be less likely to call and complain.

That said, some investors have been reporting that code compliance

officers are catching on and are now working weekends as well.

Tania Matthews, a

Keller Williams Mega Agent in

Central Florida, reported that in her area at least, code compliance

officers have been known to work weekends. This is why getting

permission from property owners or researching local regulations is

still your safest bet.

2. Some Local Residents HATE Them… and Will Hate YOU for Putting Them Up.

Source: The Adventures of Johnny Northside

No matter how you justify it, at the end of the day you’re trying to

buy houses for below market value. Worse, you’re probably trying to buy

them from vulnerable people in often desperate financial straits.

They’re also ugly. Yes, they’re strategically ugly, but would you want

dozens of bandit signs on your block?

How to avoid the Ire of the Community in 2017

Don’t use bandit signs to generate leads! If you’re dead set on using

them, try putting them out temporarily, or putting them up on private

property only.

3. You’ll Probably Violate DOS or NAR Disclosure Regulations

Source: https://www.rrar.com

Even if you get a pass from your lawyer and find a nice old lady who

lets you cover her house in bandit signs, you’ll probably still run

afoul of DOS or NAR disclosure regulations.

In most states, real estate advertising is highly regulated. The most

common advertising regulation by far is that Realtors or even sometimes

non-Realtors must fully disclose their licensure in all advertising.

That means your cleverly amatuer looking hand written WE BUY HOUSES sign

might have to include “Sally Smith, Licensed Real Estate Salesperson”.

For many homeowners, that makes you someone they’re trying desperately

to avoid: a skilled professional.

How to avoid violating DOS or NAR disclosure regulations in 2017

There’s only one real answer here and probably not the one you’re

looking for. Follow all DOS and NAR regulations regarding real estate

advertising to the letter. In 2017 advertising regulations in most

states have gotten more strict, not less strict. The odds of getting

fined for this are pretty slim, but if you’re a Realtor working under a

designated broker, they will more than likely demand you follow all

applicable regulations. For good reason too. They’re the ones that will

get fined.

4. Your Bandit Signs are Going to Get Taken Down

Since posting bandit signs in your

farm area

might run afoul of local ordinances, make the neighbors angry, or get

in the way of your competition, the odds of all your signs staying up

can be remote.

Town employees, angry local residents, or your competition might

decide to grab a utility knife or pry bar and tear your signs down. If

you’re not careful about putting them up, the weather might do that job

too.

How to avoid getting your signs torn down

Here are a few ways to make sure your signs stay up:

Create a map of where you posted signs and check on them occasionally

Throwing up a few signs and hoping for the best won’t cut it these

days. You may post 20 bandit signs on a Friday and by Saturday morning

only have three left. If you don’t remember where you put all your

signs, that means you might not be getting calls from your best

locations.

Instead, write down exactly where your signs are and take a few

minutes to check on them once a week or so. If you find a location with

competitor’s signs still up and yours torn down, that might mean it’s a

great spot and your competition is trying to keep it for themselves. Pay

special attention to these areas.

Use strong zip ties or heavy duty staples to post your bandit signs

If you’re posting signs to telephone poles or utility poles, always use

heavy duty zip ties and

contractor grade staple gun to put them up. There’s even a company that makes a

two foot long heavy duty stapler specifically designed to post bandit signs.

You also might want to consider getting a little creative with

placement. Generally speaking, the higher up they are, the more visible

they are. They’re alo much harder for people to take down. If you have

permission to post signs on a local building, use

heavy duty concrete anchors to make sure your signs stay up.

When they go low, you go high

Let’s face it. Even the most dedicated vandal or real estate investor

is probably not going to lug around a 12 foot ladder to tear down your

bandit sign. That means the higher you can get them, the safer they’ll

be. Here’s a quick video of just how easy it is to hang signs 10 feet up

with the

Sign Stapler tool.

5. There’s Too Much Competition

Source: Pexels

Let’s face it. With the rise of a hundred and one new TV shows about

flipping houses, real estate investing is trendier than Pokemon these

days. In fact, according to a study by Zillow sister site Trulia, more

than

six percent of all homes sold in 2016 were flips. That’s the highest percentage we’ve seen in

more than a decade.

That means your new investment strategy is probably going to be shared

by more than a few people in your town. If you happen to work in one of

the cities that Trulia found to be flipping hotspots like Las Vegas or

Tampa, then there might be enough would-be investors in town to fill a

minor league baseball stadium. Here’s how you can live with the

competition.

If you can’t beat them…

Your grandmother’s best advice (besides to always wear comfortable

shoes) applies to real estate investing too: If you can’t beat them,

join them. Instead of viewing your local investors as competition, why

not reach out and try to work with them? Real estate investors are not

all cut throat Gordon Gekko clones. In fact, some of them can be

downright friendly and actually want to work with other local investors.

No one has all the money, all the time, or all the connections in the

world.

Meeetup.com and

Bigger Pockets host

hundreds of real estate investing meetups every day. If you keep seeing

the same “I BUY HOUSES FAST CA$H” sign with the same phone number, give

them a call. What do you have to lose?

6. You Might Not Get Any Leads

Source: imgflip.com

Of course like any

lead generation strategy,

there is a possibility that spending an entire day putting up bandit

signs won’t get you any leads at all. Here are a few ways to tweak your

bandit sign strategy to make sure your phone rings.

Your signs need to stand out

In order for people to see your sign and decide to pick up the phone,

your signs need to stand out. A good rule of thumb is that if your sign

is not legible enough to be read and understood from 20 feet away you

need to go back to the drawing board.

In order to make sure your signs stand out, come up with a dead

simple message “I BUY HOUSES ALL CA$H” along with your phone number in

big, bold text (black), and choose a bright, highly visible background

color (yellow or orange are pretty popular).

Pick your locations strategically

Like everything else you do in real estate, there is one mantra that

should be in the back of your head when you’re putting up bandit signs.

Location, location, location. What good is putting up a hundred

perfectly designed signs if no one ever sees them?

Some locations to consider when posting bandit signs might be busy

intersections, downtown areas close to mass transit. Shopping centers,

malls, banks, Home Depot, check cashing companies, and payday loan

offices.

Since many people will be driving by your sign at 30+ miles per hour,

higher is generally better than lower. That means telephone poles,

utility poles, or if you’re lucky, on commercial or residential

buildings in busy areas.

Quantity over Quality?

There are two schools of thought here. One is that the more signs you

have up, the more calls you get. While this may be true to some extent,

if you were to actually track where the majority of your calls are

coming from, you might find that you get 90% of your calls from 10% of

your signs. Why not save yourself the headaches and mileage and only

maintain your signs where you’re getting calls from?

Use a google voice number to track your results

Since bandit signs probably aren’t going to be your main lead

generator, you need to be able to quickly and easily track who is

calling you from your signs. One easy way to do this is to set up a

google voice number and use that on your sign.

You can even set up several numbers if you have signs up in more than one neighborhood, then use

call tracking software to easily identify the most effective locations.

The Bottom Line

Although bandit signs can be a tricky way to get leads, if you have

check your local laws, find the right locations, and take time to

maintain your signs, they can be a great way to build your business.

Bandit

sign is not just a catchy name. Bandit signs are called bandit signs

for a very good reason; in many municipalities bandit signs are actually

illegal.

Bandit

sign is not just a catchy name. Bandit signs are called bandit signs

for a very good reason; in many municipalities bandit signs are actually

illegal.